- #Comparitive income statement in multiledger full#

- #Comparitive income statement in multiledger professional#

- #Comparitive income statement in multiledger series#

Class +2 Accountancy by Sultan Chand & Sons (P) Ltd.If you have any questions, please ask us by commenting. Please comment your feedback whatever you want. Profit and Loss Account: Meaning, Format & Examples Indirect Expense = All business expenses other than direct expenses.Indirect Income = Other incomes which are earned from Business other than the main operation of the business.

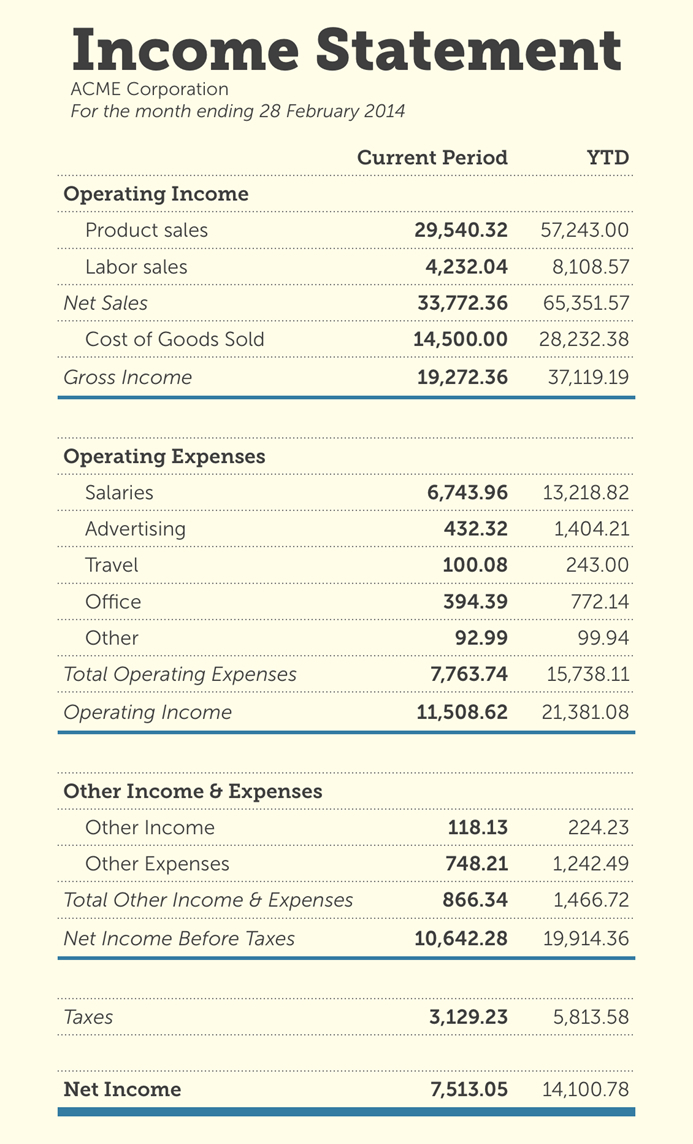

Net Profit/Loss = Gross Profit/Loss + Indirect Income – Indirect Expenses In addition to dollar values, the income statement. It is calculated by deducting indirect expenses from the Gross Profit/Loss. and adding indirect income/revenue int the Gross Profit/Loss. An Income Statement shows whether or not your company has earned a profit. It is prepared to find out the Net Profit/loss of the business for the particular accounting period. Profit and loss account is the statement which shows all indirect expenses incurred and indirect revenue earned during the particular period. Considerations: Audit of Comparative financial statements - Supplementary. Capital shows the amount invested by the owner into the business entity.īalance Sheet: Meaning, Format & Examples 2. Single Ledger Creation-Multi Ledger Creation-Altering and Displaying Ledgers. This type of financial statement can be used to allow for easy. What-if MIS system uses its stored information, its comparison and calculation capabilities, and a set of programs especially written for this situation to provide management with the consequences of an action they are considering. Common size income statement is an income statement in which each account is expressed as a percentage of the value of sales. The value of assets showing which we can realize from the market and The value of Liabilities shows which we have to pay in the future. MIS is a function that generates reports such as income statements, balance sheets, and cash flow reports. It is a list of balances of ledger account of assets, capital, and liabilities.

The Balance Sheet is the statement showing the position of the assets and liabilities of the business in a particular accounting period. The two types of financial statements are included in the process of the comparison of the financial statements. Statements included in the comparative statement: When the comparative statement is prepared from the financial statements of the two of more firms for the same period then it is known as an inter-firm comparison of financial statements.

When the comparative statement is prepared from the financial statements of the single firm for the period of two or more years then it is known as an intra-firm comparison of financial statements. There can be two types of comparative statements which are shown as follows: 1. Intra-Firm Comparision: When the comparative statement is prepared from the financial statements of the single firm for the period of two or more years then it is known as an intra-firm comparison of financial statements.

#Comparitive income statement in multiledger series#

You can select a consecutive series of accounts (for details, see Making Selections in a Reports List ). If necessary, scroll the list to find the name or names of the account or accounts that you want. It is the tools for the analysis of the financial statements of the business. Type of the comparative statements: There can be two types of comparative statements which are shown as follows: 1. Select the account or accounts to be reported. The components of the two or more years are shown side by side on the same page and then calculate the change from the base year of all the elements. Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 $ 255,400 250,000 903 500 20-1 Cash Government notes Accounts Receivable (net) Menchandise inventory Supplies and prepayments $ 43,200 250,000 797 500 913,600 47 500 108,200 983,600 143,200 108,200 330,000 Land Building (net) Office equipment (net) Total assets 17,700 $2.The comparative statements are that statement which shows the comparison between the component of the financial statement of the business for the period of more the two years.

#Comparitive income statement in multiledger full#

a full set of financial statements including different scenarios (e.g. System Interface with EXCEL (Download from IT8/Upload into IT15) List Leave Encashment Requests. Comparing with traditional financial close consolidation your.

#Comparitive income statement in multiledger professional#

Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 Net Sales (all on account) Cost of goods sold Gross Profit Operating expenses Other expense (interest) Income tax expens Net Income $2.584,000 1,868,200 $ 715,800 315,200 24,200 176,800 $ 199,600 20-1 $2,163,000 1,616800 $ 546,200 221,800 24200 106,300 $ 193,900 Cowan Kitchen Counters, Inc. HR-HK: Periodic MPF contribution report (format: bank of Bermuda) HR:India Professional Tax reporting Annual form for Maharashtra HR-IN: Batch program for Income From Other Sources (Housing) Batch Prgram For Section 88 - INDIA.

0 kommentar(er)

0 kommentar(er)